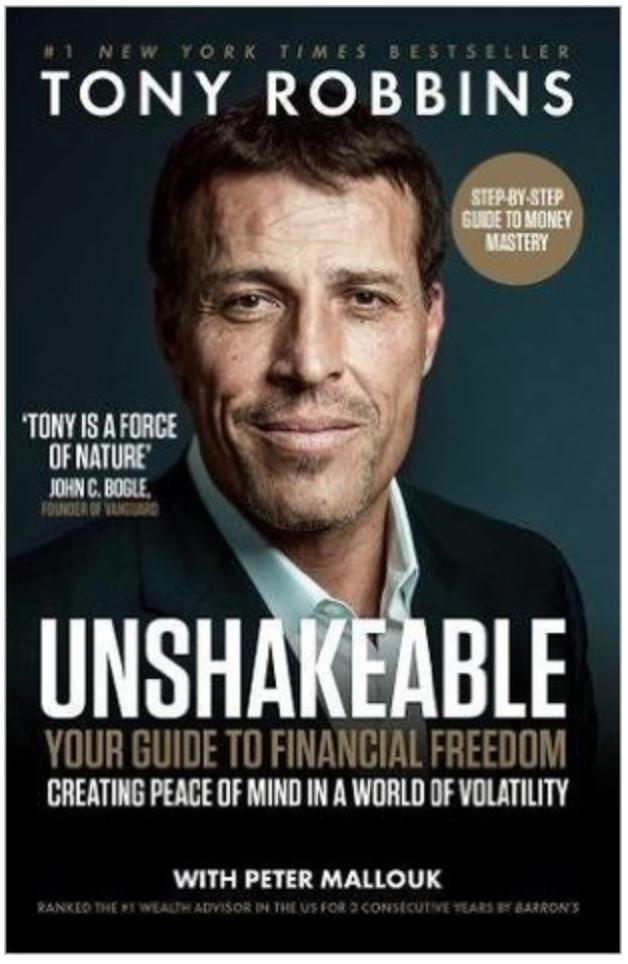

Unshakeable by Tony Robbins

My Rating: 7.5 / 10

I have read many Tony Robbins books, however this is the first finance book of his I have read. Robbin’s books are typically very large which come with a lot of detail. Money: Master the Game is a good example, however I wanted to start with a cut down version first. Unshakeable is that book.

Unshakeable is broken down into three key areas. The first on a set of rules to abide by in the financial world. For example, understanding fees, who to trust etc. The second is a set of principles when investing. The last focuses on psychology which to me is one of the areas I needed to reflect on some more.

Throughout the book I learned many things I could apply in my investing life. With that said there were many statistics that are not necessarily explained. For example, my second takeaway is a perfect example. Robbins states the impact on fees against your retirement income. I would prefer to see a little more detail on how that is calculated. Perhaps that is the detailed person in me? Or maybe it is in the bigger book!

I will get around to reading Money: Master the Game within the year but this was a good stop gap for now.

Three key takeaways from the book:

- We are quite emotional when it comes to reacting to ups and downs in the market. Whilst there is potential to beat the market, the likelihood for perfect timing is low. It is much easier (and better) to ride the market with its ups and downs by keeping a broad and diverse set of investments and not react.

- Fees are one of the biggest killers in investment. If you overpay by 1% it can cost you up to 10 years worth of retirement income. Obviously there are a lot of variables that makes this number up which aren’t described in the book. The point is to reduce the amount of fees you pay in your investments as a first important step.

- Diversification. We all know this is a good strategy however Robbins breaks diversification into four areas. The first is across asset classes, second within asset classes, third across markets/countries/currencies and fourth across time.